Customer Experience Management in Financial Services

Innovate with customer focus

Develop innovative financial products and applications with top-notch user experience to ensure customer loyalty and longevity in a world of disruption.

Learn how we use your personal data in our privacy policy and about our country/region options

Develop innovative financial products and applications with top-notch user experience to ensure customer loyalty and longevity in a world of disruption.

Inform, prioritize, and scale digital transformation initiatives based on deep and targeted customer insights for true value creation

Identify and place customers’ unique needs at the core to create products with customers, not for them

Uncover customers’ preferences, behavior, and motivation to simplify and personalize digital experiences and in turn boost customer satisfaction

Augment the data in your system of record with hard-to-reach customer insights that contextualize existing data

Overview

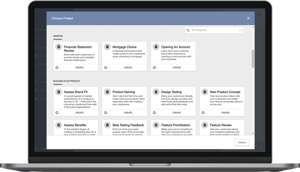

Activity Templates

Alida’s financial services industry solution offers curated, banking-specific survey templates that can be easily customized and used to collect customer feedback on banking products as well as experiences delivered across customer journeys.

Activity Templates

Activity TemplatesBendigo Bank, Australia’s fifth largest retail bank, transformed how it uses insights to keep pace with customer expectations. Truly customer first, Bendigo Bank leverages insight from its miVoice community to scale CX initiatives across products and services. Bendigo Bank has placed in the top spot on Forrester’s CX index three years in a row, with its online community contributing to that success.

With our unique, relationship-based approach, the Community platform enables financial institutions to:

Directly interact with thousands of customers in a secure online community, on demand, at scale, and in full compliance with regulatory requirements like GDPR and CCPA.

Combine deep customer insight and broad customer feedback to make data-driven decisions in hours rather than days or weeks.

Connect feedback to existing customer data and diagnose actionable ways to increase customer satisfaction.

Create an open, centralized, and secure space so historical customer insights are available to decision-makers when they need them.

.png)

"The B Part of It community has been an invaluable new resource to enable the rapid testing and development of new concepts and propositions. The speed of response enables customers to directly influence the design thinking process, enabling the community to co-create concepts with us. A game-changing approach to insight for CYBG."

David Judic, Head Of Customer Innovation, Clydesdale & Yorkshire Bank

Accelerate Innovation

Improve Customer Satisfaction

Drive Revenue Growth

Co-create and test product concepts with highly engaged, well understood customers.

Clydesdale & Yorkshire Bank used rapid insights gained through their insights community to launch a new digital banking app geared at a younger digital savvy customer. They have a 20% response rate within the community (vs. a historic 3%) and have reduced research costs.

Diagnose sources of dissatisfaction and align action with better understood customer segments.

Bendigo Bank, Australia’s fifth largest bank uses insights to keep up with customer expectations and test/scale CX initiatives. Based on insight from their community members around pain points in their banking process, they made changes that led to 79% faster customer service. Similarly, they saw a drop in complaints about phone queues of 90%.

Develop and align relevant services and offers with customer needs to fuel business growth.

AIA Singapore has developed an innovative suite of financial products and services informed by insight gained through their AIA360 community. Leveraging this insight has allowed them to achieve a 40% YOY increase in revenue from AIA’s Retirement Saver products, increase digital traffic on Vitality mobile app by nine times, and also achieve a three-point increase in NPS.

Our platform is delivered as a cloud-based, multi-tenant, Software as a Service (SaaS) application accessed by members via a web browser. No software or add-ons are installed on any computers. Our many customers within the financial services industry rely on Alida because of our dedication to their data security and privacy needs and the controls we have in place to support them.

Security Data Sheet

to Rapidly Changing Customer Needs in the Age of Coronavirus

AIA Singapore uses agile, ongoing insight to increase conversion, build loyalty, and ...

How Virgin Money UK successfully embraced the digital disruption in the banking industry

How Bendigo Bank supports customer-led decision making in real-time

How Prudential Singapore accelerates product growth with customer insights

How AXA Philippines innovates in line with customer needs

Learn how Community's relationship-based approach progressively profiles the customer at every interaction producing richer customer insights.

Get a Demo